The State of Texas has been a leader in the pushback against environmental, social and governance (ESG) policies, passing some of the first anti-ESG laws in the country. Last week, Texas Attorney General Ken Paxton moved to protect the coal industry from what Paxton says is an effort on the part of large investment firms to not only shrink coal companies — but also unfairly profit from them.

Read MoreTag: ESG

House Passes Bills to Protect Employee Benefit Plans from Politicization

A package of bills to ensure employee benefits plans prioritize financial well-being over “woke” policies has been passed by the U.S. House of Representatives.

Outgoing Virginia Republican Rep. Bob Good sponsored the Protecting Americans’ Investments from Woke Policies Act and the No Discrimination in My Benefits Act, which cleared the House 217-206.

Read MoreWoke 2.0: ESG Critics Say the Same Movement Marches on, Only with a New Name

BlackRock began renaming environmental, social and governance (ESG) earlier this year. It’s now calling it “transition investing.”

The company recently updated its climate and decarbonization stewardship guidelines. The document makes no mention of ESG, but it shows in many ways, the world’s largest investment manager with $10 trillion in assets under management is still pursuing many of the same goals.

Read MoreCorporate America is Starting to Shy Away from Woke Business as Backlash Mounts

American companies are reversing the multiyear trend of hiring more employees in roles related to environmental, social and corporate governance (ESG) issues in an effort to increase profitability and address investor pushback, according to The Wall Street Journal.

U.S. companies shed 3,071 employees with positions related to ESG in December while only adding 2,897, continuing the trend that has been seen in half of the months in the last year of a net loss of ESG positions, according to the WSJ. The shift is in response to investors pulling their funds from companies heavily involved in ESG practices and placing their money in firms where they can get higher returns.

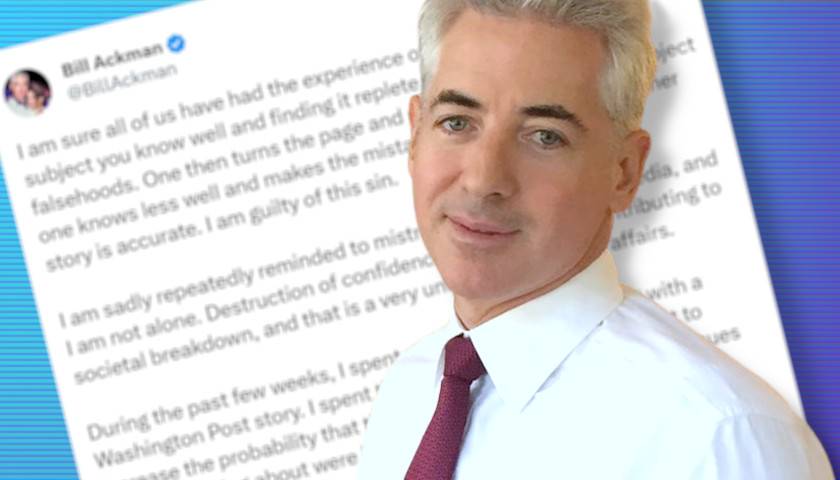

Read MoreBill Ackman on Washington Post Hit Piece: ‘The Public Has Been Again Misled’

Bill Ackman, the highly successful investor and Harvard graduate whose criticism of Claudine Gay’s history of plagiarism led to her resignation as President of Harvard University, published a lengthy tweet on his X account Saturday evening responding to an article about him published by The Washington Post earlier in the day, “How a liberal billionaire became America’s leading anti-DEI crusader.”

Read MoreMarket Share for Green Bonds Slumped for Another Year Following Backlash

Bonds that consider environmental, social and governance (ESG) factors for their investors made up just 2% of all bond issuance in the U.S., the lowest point in terms of market share since 2020 after also declining in 2022, according to Bloomberg.

ESG bond issuance as a percentage of the market reached an all-time high in 2021 and is not expected by analysts to reach that same high in 2024 as interest rates make the bond market pricier and backlash to the ESG label inhibits sales, according to data compiled by Bloomberg. ESG has come under fire by conservatives who see it as a left-wing initiative infecting the financial world, most recently leading Ohio Republican Rep. Jim Jordan, chairman of the House Judiciary Committee, to send subpoenas to financial firms Vanguard, Arjuna Capital, BlackRock and State Street Global Advisors over alleged ESG collusion, arguing it violates antitrust law.

Read MoreCommentary: The Left’s War on Mobility Is Making the Holidays Miserable, But It Has Far More Sinister Motives

Never before has so much ‘infrastructure’ been funded and so little built.

Unless, that is, you label Pete Buttegieg’s ‘paternity’ leave as ‘human infrastructure.’ Which, by the way, is exactly what the Biden administration did with its trillion dollar infrastructure boondoggle in 2021.

Read MoreCommentary: Republicans in Congress Need to Do More to Defund ESG

“Anti-woke economic terrorists have now wiped out $5 trillion in stock value.”

That was a headline from Afru.com bemoaning the sideways performance of Environmental, Social and Governance (ESG) funds the past year or so, accusing anyone opposed to ESG with inflicting “economic terrorism” and “erod[ing] financial portfolios of color” as “global investments in ethical companies have nosedived by nearly $5 trillion over the past two years.”

Read MoreCommentary: Rumors of ESG’s Demise Are Greatly Exaggerated

Consumer and Republican backlash against Environmental, Social and Governance (ESG) investments has increased dramatically in the past year as states, Congress and presidential candidates have taken on the issue, promising to rein in the largely green-conscious movement of capital amid spiraling energy and food costs since 2021.

Boycotts of brands such as Bud Light, Disney and Target, coupled with statements by Blackrock CEO Larry Fink that he no longer wanted to call these so-called sustainable investments ESG— at Aspen Ideas Festival on June 25 Fink said “I’m not going to use the word ESG because it’s been misused by the far left and the far right… we talk a lot about decarbonization, we talk a lot about governance … or social issues, if that’s something we need to address…”—and reported outflows from ESG funds in 2023 have painted a gloomy picture for green and socially conscious investing.

Read MoreIvy League Business Schools to Offer ESG Majors and Courses in Fall, Despite Controversy

Despite the controversiality of the curriculum, business schools are still following the Environmental, Social, and Governance (ESG) initiative.

The Harvard Law School Forum on Corporate Governance defines ESG as an effort that “grew out of investment philosophies clustered around sustainability and, thereafter, socially responsible investing,” though “there is no single list of ESG goals or examples, and ESG concepts often overlap.”

Read MoreCommentary: BlackRock and Its ESG ‘Voting Choice’ Ruse

Amid growing criticism of its environmental, social and governance (ESG) investment practices, BlackRock has announced that it will offer retail investors in its largest exchange-traded fund (ETF) the opportunity to participate in its “Voting Choice” program. Open to institutional clients since January 2022, this program allows investors to choose from a limited set of options to guide BlackRock in voting their shares. While perhaps an effective PR tool, Voting Choice is little more than a ruse that neither empowers investors nor diminishes BlackRock’s power to impose its ESG goals on American businesses.

Read MoreAmerican Financial Titans Are Straying from Green Investment Strategies as GOP Pushback Mounts, Report Finds

Several leading American asset managers have decreased their support for environmental, social and governance (ESG) resolutions since 2021, according to a new report by InfluenceMap, a nonprofit that tracks climate policies in Western corporations.

InfluenceMap’s report assigned BlackRock, Vanguard, State Street and Fidelity environmental stewardship grades of C+ or lower, which indicates that each firm exhibits “a lack of effective climate stewardship processes and use of shareholder authority to engage companies to transition” to a green energy, net-zero carbon emissions future. The report also noted that 2022 saw a “considerable” drop in corporate support for ambitious green shareholder resolutions, a development that coincides with increased Republican scrutiny of corporate ESG policies and mandates.

Read MoreCommentary: SCOTUS’ Decision on Affirmative Action Could Spell Big Trouble for ESG’s ‘Diversity, Equity and Inclusion’ Hiring Quotas

It’s a simple ruling: “Eliminating racial discrimination means eliminating all of it.”

On June 29, the Supreme Court affirmed Title VI of the Civil Rights Act, 42 U.S. Code § 2000d’s prohibition on racial discrimination in federally funded programs, including higher education, at both public and private universities, in the Students for Fair Admissions v. Harvard decision.

Read MoreCommentary: The International Energy Agency’s Net Zero Roadmap Will Increase Energy Costs

Two years ago, efforts by climate activists and Environmental, Social, and Governance (ESG) investors to block investment in oil and gas production by Western companies appeared to have received a seal of approval from no less an authority than the International Energy Agency (IEA), when it published Net Zero by 2050: A Roadmap for the Global Energy Sector. As a result, attempts to achieve net zero carbon emissions (NZE) by 2050 became central to the “E” in ESG and the IEA’s net zero roadmap has come to define the NZE baseline for energy companies.

Read MoreCommentary: Does Anyone Buy That the Head of BlackRock Is ‘Ashamed’ of ESG?

The big news in energy this week is that BlackRock CEO Larry Fink says he is no longer using the term “ESG” in his business communications. Even more, Mr. Fink is now “ashamed” to be a participant in the debate on the issue. At least, that’s what he initially said on Sunday to an audience at the Aspen Ideas Festival, where he was a speaker.

“I’m ashamed of being part of this conversation,” Fink said as quoted by Axios. But almost as soon as he made the admission, Fink took it all back when pressed by his session’s moderator. “I never said I was ashamed,” he said, even though he had just actually said that very thing. “I’m not ashamed. I do believe in conscientious capitalism.”

Read MoreCommentary: Hollywood Is Demoralizing Americans, One Story at a Time

As a young boy, I lived for a time under the rule of a totalitarian regime when visiting my parents’ homeland of Iran during the 1980s. It was only a few years after the Iranian Revolution of 1979, and the despotic new ruler, Ruhollah Khomeini, was investing heavily in his cultural propaganda machine. The Ayatollah’s dubious aim, like any new totalitarian, was to erase the proud culture of ancient Iran and replace it with one new and ideologically approved.

Read MoreCommentary: Energy Companies Are Finally Backtracking on Their Absurd Green Goals

Is the public finally waking up to the inherent absurdities taking place in the energy space in the U.S. and across the Western world in recent years? Recent votes taken on ESG and climate change-related shareholder initiatives at major oil company annual board meetings indicate that may well be the case.

Though it has received scant attention across the legacy news media in general, the Financial Times reported recently that such shareholder initiatives were overwhelmingly rejected by shareholders of both ExxonMobil and Chevron, with most receiving less than 10 percent support. Similar initiatives in the previous few years would typically generate support in the 30-40 percent range, with a handful even gaining majority support.

Read MoreInvestment Standards Debate Moves into State Legislatures

Environmental, social and governance (ESG) investment standards are a hot topic among Republican lawmakers across the U.S. who see it as a political move to force a progressive agenda.

Democrats, on the other hand, see it as a smart investing strategy.

Read MoreRon DeSantis Rips Right-Wing ‘Corporatists’ in Call to Crack Down on Big Business

Republican Gov. Ron DeSantis of Florida fired back at Republican critics of his efforts to rein in big businesses, calling them “corporatists.”

DeSantis signed legislation May 2 that prohibited state agencies and local governments from considering Environmental, Social and Governance (ESG) factors when issuing bonds, barred banks from considering “social credit” when making loan decisions and prohibited discrimination on the basis of political, social or religious ideology. Businessman Vivek Ramaswamy, former Ambassador to the United Nations Nikki Haley and former President Donald Trump have criticized DeSantis, a potential 2024 candidate for the Republican presidential nomination, over the feud with Disney that started after DeSantis signed parental rights legislation in March 2022 over the company’s opposition.

Read MoreCommentary: It’s Time to Take the Unnecessary Politics Out of ESG and Retirement Savings

Increased politicization of “environmental, social and governance” (ESG) factors in investment has resulted in one side claiming it only promotes social and political objectives, and the other side claiming that ESG is always relevant to making sound investment decisions.

President Biden’s veto of a Congressional resolution, regarding recently finalized amendments to a 2020 Department of Labor (DOL) administrative rule on retirement security, has brought ESG to the forefront again. The DOL’s amendments address how fiduciaries of a person’s 401(k)s and private pension funds make decisions about their retirement savings and the role of ESG in making those investment decisions. The DOL, under ERISA (Employee Retirement Income Security Act of 1974), regulates private retirement plans. ERISA covers roughly $12 trillion in retirement savings for 150 million Americans.

Read MoreTrump’s Truth Social Soars to Best Month Ever, as Lawmakers Question SEC Behavior in Merger Review

As former President Donald Trump’s social media platform soared to its best month ever, a growing number of Republicans in Congress are expressing concern that the Biden Securities and Exchange Commission may be slow-walking a compliance review to thwart a merger that could inject hundreds of millions of dollars into Truth Social from investors.

Read MoreCommentary: Fox News’ Lean into ESG

After Tucker Carlson’s firing by Fox News, do high ratings even matter anymore?

That might be a good question one might ask from Fox News’ termination of Carlson, the station’s most highly rated host, who was easily winning cable news’ battle for the 8pm slot for years, with an average 3.25 million viewers a night for the past four months.

Read MoreBiden Issues First Veto of Presidency, Allowing Labor Deptartment to Use ESG Factors in Investments

President Biden on Monday issued the first veto of his presidency, blocking a measure passed last week by Congress to overturn a Labor Department rule allowing retirement plans to consider environmental, social and governance factors when making investment decisions.

The GOP-led effort received congressional passage last week in the Democrat-controlled Senate, with the White House saying it would likely get a presidential veto.

Read MoreRon DeSantis to Lead 18 States in Alliance Against Woke Investing

Florida Gov. Ron DeSantis is leading an 18-state alliance to combat “woke” environmental, social and governance (ESG) investment policies.

The alliance, formally announced Thursday, comes after President Joe Biden vowed to veto an anti-ESG bill that intended to roll back a Department of Labor rule allowing pension and retirement fund managers to weigh ESG factors when determining investments. The governors will lead “state-level” initiatives to protect “Americans’ financial freedom” by allocating state funds accordingly.

Read MoreCommentary: SVB, ESG, and Biden’s ERISA Rule

The collapse of Silicon Valley Bank (SVB) occurred just days after Congress passed the Braun-Barr resolution, which overturns the Biden administration’s “Prudence and Loyalty” rule and its encouragement of environmental, social, and governance (ESG) investing by pension managers under the Employee Retirement Income Security Act (ERISA). The timing could hardly be more instructive. The Prudence and Loyalty rule, the White House had recently argued in its defense, “reflects what successful marketplace investors already know – there is an extensive body of evidence that environmental, social, and governance factors can have material impacts on certain markets, industries, and companies.”

Read MoreBlackRock CEO Scales Back Emphasis on Climate Investing: Not the Environmental Police

CEO Larry Fink of investing titan BlackRock put reduced emphasis on climate and other environmental, social and governance (ESG) goals in an annual letter to the company’s investors and stakeholders Wednesday, amid Republican criticism of his firm’s investing strategy.

BlackRock has faced significant criticism from Republicans, who allege that the company has focused too much on “woke” investing to the detriment of its clients, and more recently Democrats who argue the company hasn’t gone far enough with its ESG efforts. Fink’s reduced emphasis on his firm’s role in the energy transition stands in stark contrast to his 2020 letter to investors, in which he argued the company had a “significant responsibility … to play a constructive role” in the transition to low-carbon sources of energy, Axios reported.

Read MoreFlorida’s Upcoming Legislative Session to Include Long List of GOP-Backed Bills

Florida’s legislative session will reconvene on Tuesday, and several GOP-backed bills are set to make their way to Gov. Ron DeSantis’ desk ahead of a possible 2024 campaign launch, according to Politico.

The Republican supermajority legislature will propose various conservative bills over the next two months, including legislation relating largely to education, along with other gun rights, immigration and death penalty proposals, Politico reported. These GOP-led efforts come before a likely presidential announcement by the governor to give him more legislative successes to campaign on, according to Politico.

Read MoreFlorida’s Chief Financial Officer Warns NewsGuard Against ‘Disinformation’ Attack on Conservative Groups

Jimmy Patronis, the state of Florida’s chief financial officer, is warning the top executives of a so-called “disinformation” tracking group it’s playing with fire in targeting conservative organizations in what has been described as a defunding campaign. In a letter to NewsGuard CEOs and Editors-in-Chiefs Steven Brill and Gordon Crovitz,…

Read MoreCommentary: Corporations Embracing ESG Must Lose Their Legal Protection

ESG, an acronym for Environmental, Social, and Governance, is everywhere. If you work for, advise, invest in, regulate, study, or otherwise care about one or more corporations, you’ve likely encountered the term. Consultancies, banks, investment funds, managers, governments, and international organizations trip over themselves touting their ESG scores and credentials.

Read MoreRed States Use Purse Strings to Check Momentum of ESG Woke Investing Movement

With the woke investing movement known as Environmental Social and Governance gaining steam in corporate boardrooms and asset management firms across the U.S., red states are pushing back.

The ESG counteroffensive includes economic and legislative moves ranging from the leveraging of public investment to laws mandating that fiduciaries of public funds make investment choices based on financial rather than ideological criteria.

Read More25 States Sue Biden Administration over Federal ESG Policy

Twenty-five attorneys general and several other plaintiffs have sued the Biden administration asking the court to halt a federal ESG policy that could negatively impact the retirement savings of 152 million Americans. The lawsuit was filed in U.S. District Court Northern District Amarillo Division naming Secretary of Labor Martin Walsh and the U.S. Department of Labor as defendants.

Read MorePrestigious Business Schools Train Students in Woke Capitalism

Prestigious business schools across the country are adding more opportunities to study diversity equity and inclusion (DEI) and environmental, social, and governance (ESG), a trend that’s expected to continue, professors told the Daily Caller News Foundation.

ESG prompts investors to consider factors such as environmental impact and social awareness when making investments, while DEI is a push to increase diversity and inclusion initiatives in institutions such as schools and the workplace. Harvard University, the University of Pennsylvania (UPenn), and Bentley University all offer courses in both subjects as they grow more prominent.

Read More’60 Minutes’ Airs Apocalyptic ‘Humanity Is Not Sustainable’ Segment to Ring in 2023

CBS’ “60 Minutes” opened 2023 by airing a segment about the dangers of population growth featuring biologist Paul Ehrlich, who has long predicted societal collapse and disaster due to high population.

Ehrlich, a Stanford University professor, said humanity was not sustainable and reiterated his concerns that the planet’s human population was crowding out the natural environment to our own peril. While the world population is still rising, the rate of human fertility plummeted by roughly 50% across the globe in the last 70 years; the average family had five children in 1952, but now has fewer than three.

Read MoreCommentary: 2022 Is the Year ESG Fell to Earth

The year 2022 brings an end to an era of illusions: a year that saw the end of the post–Cold War era and the return of geopolitics; the first energy crisis of the enforced energy transition to net zero; and the year that brought environmental, social, and governance (ESG) investing down to earth with a thump—for the year to date, BlackRock’s ESG Screened S&P 500 ETF lost 22.2% of its value, and the S&P 500 Energy Sector Index rose 54.0%. The three are linked. By restricting investment in production of oil and gas by Western producers, ESG increases the market power of non-Western producers, thereby enabling Putin’s weaponization of energy supplies. Net zero—the holy grail of ESG—has turned out to be Russia’s most potent ally.

Read MoreCommentary: ESG and the Clash of Values

In the third of his four part review of Terrence Keeley’s Sustainable, Rupert Darwall writes that ESG rests on a vision of the free-market economy that says capitalism needs to be led by people with the right values, which raises the question: Whose values? This makes ESG inherently divisive, explaining the pushback ESG is now generating in red states. Keeley proposes a solution in keeping with the pluralism and diversity of modern America.

Read MoreCommentary: ESG and the Perpetually Just-Over the Horizon Climate Apocalypse

Concern about catastrophic climate change has been the biggest factor driving ESG, yet the likelihood of climate change being catastrophic and the attainment of net zero are not open to debate or challenge by participants in financial markets. In the last of his four part review of Terrence Keeley’s Sustainable, Rupert Darwall argues that this undermines the function of financial markets as efficient, unsentimental allocators of people’s savings in a way that maximizes growth and economic well-being.

Read MoreCommentary: The ESG Reality Is Not Doing Good But Feeling Good

ESG investment strategies can see investors giving up financial returns for no societal gain. In the second of his four part review of Terrence Keeley’s Sustainable, Rupert Darwall explores the implications of investment theory for ESG artificially constraining investment opportunities; the risks of regulators worsening an already inflated ESG bubble; and the distortions that arise from the widespread adoption of sustainability as an investment concept lacking an objective definition.

Read MoreCommentary: Review of Terrence Keeley’s ‘Sustainable’

ESG has its origins in a speech by UN secretary-general Kofi Annan at the Davos World Economic Forum in 1999. In the first of his four part review of Terrence Keeley’s Sustainable, Rupert Darwall shows how this created ESG’s dual mandate that accounts for its success – and its unsustainability as an investment strategy.

Read MoreLabor Department Approves Investing Pensions in ‘Woke’ ESG-Only Funds

The U.S. Labor Department announced plans to allow pension fund managers to “consider climate change and other environmental, social and governance factors,” also known as ESG, when choosing investments.

In an announcement about the final rule last week, the agency criticized the Trump administration, stating, “the department concluded that two rules issued in 2020 … unnecessarily restrained plan fiduciaries’ ability to weigh environmental, social and governance factors when choosing investments, even when those factors would benefit plan participants financially.”

Read MoreNew Republican Majority Plans to Target ‘Woke’ Businesses

One of the top agenda items for the GOP’s new majority in the House of Representatives is the targeting of “woke” corporations on Wall Street, threatening investigations and other government action if such companies do not reverse anti-American policies and practices.

Politico reports that some of the measures the GOP will be scrutinizing include “ESG (environmental, social, and governance)” policies, divesting from fossil fuels, and race-based affirmative action hiring policies for the sake of “diversity.”

Read MoreCommentary: The Nonsense of Stakeholder Capitalism

From Harvard to Hong Kong, stakeholder capitalism is gaining popularity at elite business schools worldwide. Followers of this trendy concept believe that a corporation, instead of primarily operating to benefit shareholders, should work to benefit all interested parties — or “stakeholders” — including suppliers, local communities, and governments. Stakeholder capitalism largely overlaps with efforts to advance so-called “environmental, social, and governance” (ESG) outcomes — a vaguely defined trio of left-wing priorities.

Read MoreCommentary: ESG Is Evil

The Environmental, Social, and Governance (ESG) scoring system is undergoing intense scrutiny. It also has become quite a political football, with conservative governors, attorneys general, and other officials pushing back against the movement while progressive politicians argue that ESG needs to go further.

This political tug-of-war has exposed the evil essence of ESG: It is an attempt by progressives to arm-twist the leaders of investment firms controlling the allocation of over $20 trillion in investment capital away from firms disfavored by progressives, including, most notably, producers of fossil fuels.

Read MoreBlackRock Stock Downgraded over Investments in ESG

The asset management company BlackRock, which has been widely criticized for promoting multiple far-left concepts in the world of business, has seen its stock downgraded due to ongoing backlash.

According to The Daily Wire, UBS analyst Brennan Hawken downgraded the company last week due to its support for Environmental, Social, and Corporate Governance (ESG) policies. The target stock price was reduced from $700 to just $585, resulting in a one percent drop in BlackRock shares on Tuesday.

Read MoreRepublican Treasurers Pull $1 Billion from BlackRock over Alleged Anti-Fossil Fuel Policies

Republican state treasurers are withdrawing $1 billion in assets from BlackRock’s control due to the asset manager’s alleged boycott of the fossil fuel industry, according to the Financial Times.

Republican South Carolina State Treasurer Curtis Loftus is pulling $200 million from BlackRock by the end of 2022, and Louisiana treasurer John Schroder said on Oct. 5 that he is divesting $794 million from the company, according to the FT. Utah treasurer Marlo Oaks said he removed $100 million in funds from BlackRock’s control, and Arkansas treasurer Dennis Milligan pulled $125 million from the company in March.

Read MoreCommentary: ESG Cancel Culture Comes for State Financial Officers

As the leader of a nonprofit group whose mission is to promote economic freedom, sound public policy, and responsible financial management at the state level, I’m honored to help our nation’s financial officers practice good stewardship of taxpayer dollars. Their work often includes managing pension funds that are vital to millions of Americans’ retirement security. Over the past few years, a growing threat called ESG (Environmental, Social, Governance) has been negatively impacting state pension systems, ultimately putting retirees at risk. Sadly, our nation’s state financial officers and the retirees they have a fiduciary responsibility to protect are increasingly under siege by ESG ideologues who are motivated by politics rather than economics.

Read MoreCommentary: The Left’s Corporate ‘ESG’ Movement Is Coming After All Americans, But We Can Stop It

In a House Financial Services committee hearing last week, Rep. Rashida Tlaib asked CEOs of major banks whether they would go along with her ESG agenda and commit to stop funding fossil fuels.

Read MoreCommentary: Mutual Funds Are Using Your Money to Push ESG

The mutual fund industry has gone “woke.” It’s not just the asset managers who screen socially “unacceptable” companies in industries involving, say, guns, fossil fuels, tobacco, or gambling. Those have been around for decades.

No, there’s something else amiss. And if you’re investing your hard-earned money, you might be part of the problem.

Read MoreMerchant Banking Organization: Gun, Ammunition Purchases by Credit Card Will be Coded

The international organization responsible for creating merchant category codes for credit card purchases has given its approval to establish one for transactions made at gun stores.

The International Organization for Standardization’s Registration and Maintenance Management Group met on Wednesday to discuss a request made by Amalgamated Bank to set up such a code.

An ISO spokesperson told The Center Square that RMMG members could not decide whether to approve the application. That elevated the discussion to the ISO leadership that oversees standards for retail financial services.

Read MoreCommentary: ‘Environmental, Social, and Governance’ Policymaking Is the Left’s Latest Destructive Tactic to Bully Business

Reports about ESG — “environmental, social, and governance” scores that progressive activists, money-management firms, and government agencies (namely, the Securities and Exchange Commission) assign to corporations — have become nearly ubiquitous in the news. There is even a website, esgnews.com, that keeps track of the latest ESG-related developments.

Read More‘Socialism in Sheep’s Clothing’: Pro-Market Leaders Combat ESG, Liberal Capture of Corporate America

Pro-market elected officials and thought leaders are fighting back against progressive activists’ creeping capture of corporate America through the Environmental Social and Governance movement..

ESG investment strategies, increasingly prevalent among large asset management firms, seek to leverage passive investors’ assets to steer corporate decision-making to promote progressive social and environmental priorities. ESG has often been compared to the “social credit” system used by China’s ruling communist elite to enforce political conformity on its population.

Read More