If approved by the Senate, Trump’s pick for Energy Secretary, Liberty Energy CEO Chris Wright, will be the first time the Department of Energy has had an executive in the energy industry lead it. In a statement on X, Wright said he’s “honored and grateful” for the opportunity.

Read MoreTag: oil

Climate Agenda Surrenders American Energy Independence and National Security to China, Report Says

China is exploiting the climate agenda to make the United States dependent on the communist country and more vulnerable to it, according to a year-long research project by the Heritage Foundation.

Read MoreInvestment Giants Leveraged Texas Universities’ Endowment Funds to Back Anti-Oil Agenda, Report Finds

Several asset managers leveraged two major Texas university systems’ endowment funds to advance anti-fossil fuel shareholder proposals in 2022 and 2023, according to a report from the conservative watchdog group American Accountability Foundation (AAF).

BlackRock-owned Aperio Group, Cantillon, former Vice President Al Gore-chaired Generation Investment Management, GQG Partners and JP Morgan Asset Management collectively manage approximately $4 billion for The University of Texas/Texas A&M Investment Management Company (UTIMCO) as of July, which handles the university systems’ endowments.

Read MoreEx-Trump Adviser Peter Navarro Says He Is on a Crusade Against Harris, Highlights Trump Successes

Former Trump adviser Peter Navarro said he is on a crusade against Democratic presidential nominee Kamala Harris while praising former President Donald Trump’s policies from four years ago.

“I’m on a crusade here…a mission,” Navarro said on a “Just the News, No Noise” special with Association of Mature American Citizens (AMAC). “I do not want anybody to ever call Kamala Harris by only her first name again. She is not a soccer star. It’s a term of somewhat endearment when it should be one of ridicule.”

Read MorePortion of World Electricity Generated by Fossil Fuels Has Fallen Two Percentage Points in 30 Years

Reports in the legacy media regularly claim that we are rapidly eliminating fossil fuels, and the energy transition is steamrolling its way to success. Data, however, appears to show a different picture.

According to the Energy Policy Research Foundation, fossil fuels remain critical to keeping the lights on. In 2023, coal, natural gas and oil-fired power plants produced 18 terawatt hours of electricity, which was 60% of the total. This was a decline of 62% in 1993.

Read MoreFederal Government Could Slash Oil Lease Opportunities in a Top Producing State

The U.S. Bureau of Land Management’s updated Resource Management Plan for North Dakota could cost the state $34 million a year for the next 30 years, North Dakota officials said in a protest filed with the agency.

The plan announced in August bans oil and gas leased on 4 million acres, which is about 99% of federal lands in the state, according to Gov. Doug Burgum. Forty-four percent of federally-owned fluid mineral acreage would also not be available for leasing.

Read MoreBiden Admin Looks to Open Up 31 Million Acres for Solar After Locking Up Oil, Gas in Huge Swath of Alaska

The Biden administration proposed to open up tens of millions of acres of public lands to solar development on Thursday after cementing restrictions on oil and gas activity across large swaths of Alaska.

The Bureau of Land Management (BLM) rolled out its proposed “Western Solar Plan,” which would put approximately 31 million acres across 11 western states on the table for possible solar development. The agency’s solar plan comes on the heels of its Tuesday announcement that it had finalized protections for 28 million acres of public land in Alaska that will effectively prohibit oil and gas activity on that acreage.

Read MoreCommentary: The Consequences of Delaying Offshore Oil and Gas Lease Sales

Offshore drilling has been a cornerstone of global energy production since the 1800s, fueling the American way of life and powering the global economy. From the early days of “on-water-drilling” to the advancement of the fixed platform units of today, offshore drilling has consistently contributed around 30 percent of global oil production. In the U.S., supply on federal offshore lands in the Gulf of Mexico alone accounts for approximately 15 percent of total crude oil production.

Read MoreDozens of Energy Orgs Ask Congress to Kill Bill They Say Would ‘Inevitably’ Lead to Carbon Taxes

Dozens of energy policy and advocacy groups signed a Monday letter to Congress to express their opposition to a bill they say could be the first step toward carbon taxes or tariffs.

The letter urges House lawmakers to vote against the PROVE IT Act, a bill that has not yet been introduced in the lower chamber but is expected to be soon. The PROVE IT Act — which has already been introduced in the Senate — would have the Department of Energy (DOE) study the carbon intensity of goods, including aluminum, steel, plastic and crude oil, produced in the U.S. and the carbon intensity of products from other countries, according to E&E News.

Read MoreDomestic Oil Production in U.S. Reached Record Levels

Domestic oil production in the U.S. reached a new record in November of 2023, hitting 13.31 million barrels per day, according to data from the U.S. Energy Information Administration.

The previous record was 13.25 million barrels per day. That was set in September 2023.

Read MoreCommentary: The Delusions of Davos and Dubai Surrounding Wind and Solar Energy

In the most recent “Conference of the Parties,” otherwise known as the United Nations extravaganza that convenes every few years for world leaders to discuss the climate crisis, several goals were publicly proclaimed. Notable were the goals to triple production of renewable energy by 2030 and triple production of nuclear energy by 2050. Against the backdrop of current global energy production by fuel type, and as quantified in Part One, against a goal of increasing total energy production from 600 exajoules in 2022 to at least 1,000 exajoules by 2050, where does COP 28’s goals put the world’s energy economy? How much will production of renewable energy have to increase?

To answer this question, it is necessary to recognize and account for the fact that most renewable energy takes the form of electricity, generated through wind, solar, or geothermal sources. And when measuring how much the base of renewables installed so far will contribute to the target of 1,000 exajoules of energy production per year in order to realize—best-case scenario—800 exajoules of energy services, the data reported in the Statistical Review of Global Energy is profoundly misleading.

Read MoreCommentary: America Must Lead on Oil and Gas

Fifty years ago this week, legislation authorizing construction of the Trans-Alaska Pipeline passed both houses of Congress and was signed into law by President Richard Nixon.

The whole process took all of five days.

Read MoreCommentary: The Looming Economic Cauldron

The current confluence of economic conundrums elevates risks massively for the prosperity of Americans, especially those of modest means. These unprecedented, concurring economic contradictions flow directly from the dire mistakes of the 2020 virus panic.

Read MoreOil Prices Hit Nine-Month High amid Supply Concerns

Oil prices reached a nine-month high amid concerns about tight oil supplies after Russia and Saudi Arabia extended supply cuts.

Brent futures, a global benchmark to measure oil prices, rose to $91.01 a barrel on Friday, according to MarketWatch, and sits at $90.44 a barrel as of Sunday morning.

Read MoreCommentary: A CIA Agent’s Analysis of the Chaos In Russia and What to Look for Next

It’s been a wild set of events in Russia over the past week – with mutinous Russian forces marching towards Moscow, President Putin addressing the nation about their treason, and then the rebels announcing they would turn back “according to the plan” – as though nothing had happened.

As these whiplashing events evolve, here are 10 key developments that former CIA Officers like me will be watching for in the near and long term…

Read MoreBiden Administration Sells Last of Released Oil from Strategic Reserve

On Thursday, the United States Department of Energy announced that it had completed the sale of 15 million barrels from the Strategic Petroleum Reserve (SPR), capping off a total of 180 million barrels released this year to combat rising gas prices.

Read MoreBiden Turns to Communist Dictatorship for Oil After OPEC Slashes Production

The Biden administration proposed a deal that will ease sanctions on Venezuela, allowing Chevron to pump oil in the country after the consortium agreed to its largest production cut since the COVID-19 pandemic, The Wall Street Journal reported Wednesday.

The U.S. will unfreeze hundreds of millions of dollars of Venezuelan state funds held up in American banks and in exchange, the country will allow Chevron to produce oil on its lands, according to the WSJ, which cited sources familiar with the deal. The proposal comes after OPEC agreed earlier on Wednesday to cut oil production by two million barrels a day, a decision the White House called “shortsighted,” according to a statement.

Read MoreTexas Bans BlackRock for Anti-Oil Agenda

The state of Texas announced new restrictions on at least 10 finance firms that have declared an opposition to oil and other fossil fuels, since such a stance could “undermine” the Texas economy that depends heavily on such fuel sources.

The Daily Caller reports that the restrictions, announced by the Texas Comptroller of Public Accounts Glenn Hegar, will prevent the companies in question from entering into most contracts with entities at the state or local level. The new policy is the result of a law passed in 2021 that requires the state government to limit its ties with anti-oil companies. As a result, the government requested information from over 100 companies to determine their stances on fossil fuels.

Read MoreTop 10 Tough Votes Democrats Had to Take During Vote-a-Rama for Massive Spending Bill

During a “vote-a-rama” on their $739 billion reconciliation spending bill that has hundreds of billions for climate and health care programs, Democratic senators had to take a series of uncomfortable votes on hot-button issues — particularly tough for those representing swing states.

The bill, which also includes federal funding for 87,000 new IRS agents, passed on a party line vote 51-50 with Vice President Kamala Harris breaking the tie.

Read MoreBiden Pursues More Foreign Oil Despite Invite from U.S. Producers

Prior to heading to Saudi Arabia, the U.S. energy industry invited President Joe Biden to visit American energy sites.

The Texas Oil and Gas Association, Texas Independent Producers & Royalty Owners Association, and over 25 U.S. energy associations invited Biden and his cabinet members to visit U.S. energy facilities throughout the U.S.

Read MoreEco Activists Sue to Stop U.S. Oil and Gas Lease Sales

Environmental groups sued the Interior Department Tuesday to challenge the first oil and gas lease sale on public lands during the Biden administration.

A coalition of environmental groups led by Dakota Resource Council filed a lawsuit in in the U.S. District Court for the District of Columbia, alleging that the sales violate the Federal Land Policy and Management Act, which requires that the Interior Department prevent “unnecessary or undue degradation” of public lands.

Read MoreBiden Admin Considers Banning All Offshore Drilling as Energy Crisis Worsens: Report

The Biden administration is mulling the prospect of banning new American offshore oil and natural gas drilling projects as fuel prices continue to spike, The New York Times reported Thursday.

The Interior Department’s Bureau of Ocean Energy Management, working closely with the White House to shape policy, will release its drafted five-year plan for new oil and gas drilling leases in federal waters to Congress by June 30, according to The New York Times, citing people familiar with the matter. The administration is likely to stop new offshore drilling projects in the Atlantic and the Pacific, and is considering whether to end leasing in the Arctic and Gulf of Mexico.

Read MoreBiden Once Again Turns to Venezuela for Oil After Shutting Down U.S. Leases

The Biden Administration is reportedly set to announce that it will lift several sanctions and other restrictions on Venezuela, allowing for the purchase of oil from the socialist dictatorship.

As reported by The Daily Caller, two anonymous administration officials said that the federal government will soon ease up some of the energy sanctions against the Latin American country, and will allow the American oil company Chevron to enter into negotiations to purchase oil from the state-owned firm PDVSA. In return for the lifting of sanctions, dictator Nicolas Maduro has tentatively agreed to talks with opposition leader Juan Guadio, who has claimed that Maduro’s rule is illegitimate and that he is the rightful president of Venezuela.

Read MoreFeds Offering 80 Percent Less in Oil and Natural Gas Lease Sales, Increasing Royalty Rate

The U.S. Department of Interior announced it is making only 20% of eligible acreage for oil and natural gas production available for leasing on federal lands to comply with a federal court order.

In his first week in office, President Joe Biden issued an executive order directing new oil and natural gas leases on public lands and waters to be halted by the Interior Department. The agency was also tasked to review existing permits for fossil fuel development.

Read MoreJanet Yellen Defends Sustainable Investing Craze That’s Trying to End U.S. Oil and Gas Drilling

Treasury Secretary Janet Yellen defended sustainable investing practices and climate change policies that have negatively impacted U.S. oil and gas drilling in an interview Friday.

“I don’t think that the ESG movement and the emphasis on climate change is creating the problems that we have,” Yellen told CNBC’s “Squawk Box” on Friday morning when asked if investors need to rethink their stance on fossil fuels. “If anything, the problem is that we haven’t moved as rapidly as we should have.”

Read MoreCommentary: Ukraine Crisis Reveals New Bipartisan Energy Opportunities

In just the last three weeks, Russia’s invasion of Ukraine has significantly altered our national energy policy landscape and dramatically shifted the political dynamics around legislative priorities and political possibilities in Congress. The roiling of global oil markets, underpinned by an already tight supply situation from the post-pandemic economic awakening, has been driven by perceived risks of supply disruption caused by the Russian invasion. Risk premiums and a formal American embargo of Russian energy have sent prices skyrocketing and revealed, once again, that we have few good short-term options when faced with energy supply challenges. While our tools are limited today, the current moment may present an important window of opportunity to develop a policy approach that reduces this vulnerability and limits our exposure next time. This renewed attention to energy security combined with a focus on fighting energy inflation has the potential to galvanize a bipartisan policy pathway that would have been unthinkable as the year began.

The broad support that materialized in Congress and the White House for a ban on Russian oil and natural gas imports earlier this month is a case in point. Remarkably, widespread congressional support for the ban occurred despite already high gasoline prices, with oil prices well over $100 a barrel and gasoline averaging more than $4.30 a gallon across the nation.

As President Biden said when announcing the ban, “Americans have rallied to support the Ukrainian people and have made it clear we will not be part of subsidizing Putin’s war… This is a step that we’re taking to inflict further pain on Putin, but there will be costs as well here in the United States.”

Read MoreBiden Administration Backtracks on Media Reports Signaling Oil, Gas Leasing Resumption

The Biden administration backtracked on reports that it is resuming the federal oil and gas leasing program in light of a recent appeals court decision.

On Friday, Reuters reported that the Department of the Interior (DOI), the agency tasked with overseeing the leasing program, was planning to resume the previously-delayed program. But a DOI spokesperson pushed back on the report, saying it overstated the administration’s position that it would begin planning the next steps, not that it had already resumed the program.

Read MoreCommentary: All of Joe Biden’s Multitude of Failures Were Foreseeable in 2020

Every single one of senile president Joe Biden’s struggles was easily foreseeable.

It’s a bold statement, since many if not most of the issues that confront a new president can’t always be seen from a distance. If it can be said that elections are always about the future, it’s just as true to claim that the future would almost certainly be shaped by yet unseen events and circumstances that no politician could forthrightly discuss in the lead-up to his victory.

Read MoreCommentary: Net-Zero and ESG Are Worsening the Energy Crisis – and Weakening the West

The day after President Biden announced that the United States would ban imports of Russian oil and gas, a group of eleven powerful European investment funds that includes Amundi, Europe’s largest asset manager, outlined plans to force Credit Suisse, Switzerland’s second largest bank, to cut its lending to oil and gas companies. The juxtaposition of these two events dramatizes the fundamental disunity of the West. At the same time as the Biden administration is sanctioning Russian oil and gas producers, Western investors are sanctioning Western ones. Under the banner of ESG (environmental, social and governance) investing, the West’s capital is being deployed to create an artificial shortage of oil and gas produced by its companies and reward non-Western oil and gas producers such as Russia and Iran with higher prices. In doing so, the West is undermining its own security interests.

Before Russia’s invasion of Ukraine, energy markets were already extremely tight. In the past, high oil and gas prices stimulated a supply-side response leading to increased output and to prices falling back. This relationship has broken down. According to analysts at JP Morgan, capital spending by S&P Global 1200 energy companies peaked in 2015 at just over $400 billion and shrank to around $120 billion last year – less than half its previous trough of $250 billion in the aftermath of the 2008 financial crisis, even though global demand is now around 15% higher than it was then.

Read MoreLeft-Wing Democrats Ask Biden to Cancel Oil Drilling on Federal Lands, Declare ‘Climate Emergency’

The Congressional Progressive Caucus (CPC), a group of 97 left wing lawmakers, urged President Joe Biden to declare a “climate emergency” and issue a series of bans on federal oil and gas leasing.

The requests were part of the CPC’s proposed agenda for executive action released Thursday that it would like to see the White House pursue moving forward. Democratic Washington Rep. Pramila Jayapal is the caucus’ chair and Sen. Bernie Sanders is its sole member from the Senate.

Read MoreDrilling Permits Spiked Under Biden Administration Before Dropping Significantly

After a massive rise in the number of drilling permits approved in 2021, the total number has plunged to some of the lowest levels ever in 2022, all on the watch of the Biden Administration.

Politico reports that after the previous high of 643 permits that were issued by the Department of Interior’s (DOI) Bureau of Land Management (BLM) in April of 2021, just 95 permits were approved in January of this year. The sudden shift reflects the wildly different approaches taken by the Trump Administration and the Biden Administration when it comes to domestic energy production.

While President Donald Trump supported unlimited domestic production in order to establish national energy independence, Biden pledged to reduce the production of fossil fuels in order to combat “global warming,” and instead has tried to promote so-called “green” energy alternatives. But the fallout from the Russian invasion of Ukraine, including the impacts on the global energy market, has forced Biden to consider restarting domestic production in order to offset rising gas prices.

Read MoreCommentary: High-Octane Solutions to the New Energy Crisis

Russia’s invasion of Ukraine and soaring energy prices are a bracing wake up call to the West to abandon our anemic energy policies, which have pretended to be green but in reality have only shifted the dirtiest parts of our energy supply chains to bad actors like Russia and China. Western energy dependence on hostile powers limits our ability to preserve peace, to reduce our supply vulnerability, and to find the most cost-effective climate change solutions.

President Biden has acknowledged some of these problems, conceding that gasoline prices are too high and promising to do “everything in my power to limit the pain the American people are feeling at the gas pump.” But gas prices continue to rise, up by 10% in the last week.

One option President Biden has not yet explored is working with Congress to fix our incoherent domestic fuel policy to improve fuel efficiency across the board and reduce the amount Americans pay for gasoline. Currently, the EPA regulates fuels and automobiles separately, instead of as a single system. Automakers have the technological know-how to make much more efficient car engines, but regulatory barriers prevent them from doing so because they do not permit the use of cleaner fuels that would reduce carbon emissions and enhance performance.

Read MoreCommentary: Five Facts on the Russian Oil Import Ban

1. Oil and gas proceeds fund more than one-third of the entire Russian federal budget.

Russia produces 12% of the world’s oil. Its economy is strongly dependent on its publicly owned oil and gas sector — which employs about 2.5 million people, and generates an average of $191 million in revenue every day for the Kremlin.

Read MoreGovernor Ron DeSantis Blasts Biden over Conversations with Venezuelan Leaders

Governor Ron DeSantis blasted the Biden administration for conversations with leaders of Venezuela, as reports detail Biden is considering purchasing oil from the South American country.

The U.S. is looking to ease the impact of the decision to ban the purchase of Russian oil and has turned to countries like Venezuela and Iran—instead of producing energy in America.

Read MoreNewt Gingrich Commentary: Biden Helping Dictators and Harming Americans

When the Biden administration appeals to Iran, Venezuela, and Saudi Arabia for oil but rejects American and Canadian oil and gas production, there is something profoundly wrong.

Why does Joe Biden think dictators are better than Americans? Why send money to Iran instead of Oklahoma – or to Venezuela instead of Texas? If he wants to send money outside the United States, why not send money to Canada rather than Saudi Arabia?

Read MoreCommentary: The Green Immoralists

Thousands are dying from Russian missiles and bombs in the suburbs of Ukraine.

In response, the Biden Administration’s climate-change envoy, multimillionaire and private-jet owning John Kerry, laments that Russian president Vladimir Putin might no longer remain his partner in reducing global warming.

“You’re going to lose people’s focus,” Kerry frets. “You’re going to lose big-country attention because they will be diverted, and I think it could have a damaging impact”

Read MoreOne Year After Refusing to Negotiate with ‘Dictator’ Maduro, Biden Changes Course over Oil

Just one year after refusing to negotiate with Venezuelan “dictator” Nicolas Maduro, President Biden appears to have changed course.

Democrats and Republicans have put pressure on Biden to cut off Russian oil imports over Russian leader Vladimir Putin’s escalating invasion of Ukraine. Russia and Venezuela are partners in several areas including oil. Putin and Maduro recently discussed increasing a “strategic partnership,” according to Reuters.

Reports of the negotiations preceded an expected announcement Tuesday morning by President Biden that the U.S. will ban oil imports from Russia.

Read MoreAnalysis: White House Keeps Misleading Public on Oil, Gas Leasing

The White House has repeatedly suggested the private sector can boost oil supply amid surging gas prices, but industry groups have countered that the administration has placed hurdles for new drilling.

“There are 9,000 unused, approved drilling permits,” White House press secretary Jen Psaki told reporters Monday. “So I would suggest you ask the oil companies why they’re not using those if there’s a desire to drill more.”

Read MoreCommentary: ‘Wokeness’ on Energy Is Weakness

As Joe Biden’s approval numbers sink further into the sewer, the only thing he’s building back better is 1970s-style inflation. Up until Biden, most polls usually named Jimmy Carter as one of the weakest and most inept presidents we’ve ever had. That was until Biden showed up and said, “Hold my beer!” Which you have to know has brought so much joy to Carter. Heck, he probably has a set of “Let’s go Brandon!” PJs that he wears every night as he thanks God for the gift of Biden.

Fact is, this country is now being “led” by a man who absolutely will go down as one of the worst presidents in our history. In just over a year, Biden has brought inflation roaring back to levels not seen in 40 years, has destroyed our southern border as millions of illegal aliens, along with Chinese fentanyl, flood the country, and now we have been involved in two major international debacles with Afghanistan and Ukraine. The list could go on, but perhaps that’s too depressing.

Rest assured, however, it’s not going to get better. Biden is like the anti-Midas, turning everything he touches into crap.

Read MoreStock Market Sinks, Oil Tops $130 as West Considers Russian Energy Sanctions

The stock market dropped during early trading Monday after the U.S. benchmark oil index briefly touched its highest level since the Great Recession.

The Dow Jones Industrial Average, an index measuring 30 major U.S. corporations, dropped 0.94% as of early Monday. The S&P index, which measures 500 of the largest publicly-traded companies, fell more than 0.93% while the NASDAQ, an index largely comprised of technology firms, declined 0.98%.

Late Sunday, the benchmark West Texas Intermediate crude oil futures hit more than $130 per barrel for the first time since July 2008. The index remained high on Monday, hovering above $118 per barrel, up more than 3%.

Read MoreMassive Bipartisan Coalition Introduces Legislation Banning Russian Oil Imports

A group of bicameral Republican and Democratic lawmakers introduced legislation Thursday that would prohibit the U.S. from importing Russian oil and petroleum products.

Senate Energy and Natural Resources Chairman Joe Manchin unveiled the Banning Russian Energy Imports Act which would ban the import of Russian oil and petroleum to the U.S. amid the ongoing Russian invasion of Ukraine. More than a dozen Democratic and Republican lawmakers announced their support for the bill.

The U.S. imported more than 670,000 barrels of oil per day from Russia in 2021, U.S. Energy Information Administration data showed. That figure represented a 24% year-over-year uptick compared to 2020.

Read MoreLargest U.S. Oil Producer Vows Net Zero Emissions by 2050

ExxonMobil, the largest American producer of crude oil, outlined its plan Tuesday to achieve net zero carbon emissions by 2050, improving upon previous goals.

The major oil producer identified more than 150 “potential steps” that will help it achieve net zero emissions on its operations within 30 years, the company announced. ExxonMobil will increase investments in carbon capture and storage technology, hydrogen and biofuels, and bio-based plastic waste streams.

“ExxonMobil is committed to playing a leading role in the energy transition, and Advancing Climate Solutions articulates our deliberate approach to helping society reach a lower-emissions future,” ExxonMobil Chairman and CEO Darren Woods said in a statement.

Read MoreFederal Judge Tosses Lawsuit Challenging Biden’s Authority to Block Keystone Pipeline

A federal district court judge granted the Biden administration’s request to dismiss a lawsuit filed by more than 20 Republican attorneys general challenging the Keystone XL Pipeline’s permit revocation.

Judge Jeffrey Brown, of the U.S. District Court for the Southern District of Texas, ruled that he couldn’t determine the constitutionality of President Joe Biden’s action because TC Energy, the pipeline’s developer, had abandoned the project. On June 9, TC Energy announced its intention to permanently halt construction of the pipeline, saying it would focus on other projects.

Biden canceled the pipeline’s federal permit immediately after taking office on Jan. 20 in an executive order. The order said the U.S. “must prioritize the development of a clean energy economy” and that the Keystone project would undermine the nation’s role as a climate leader on the world stage.

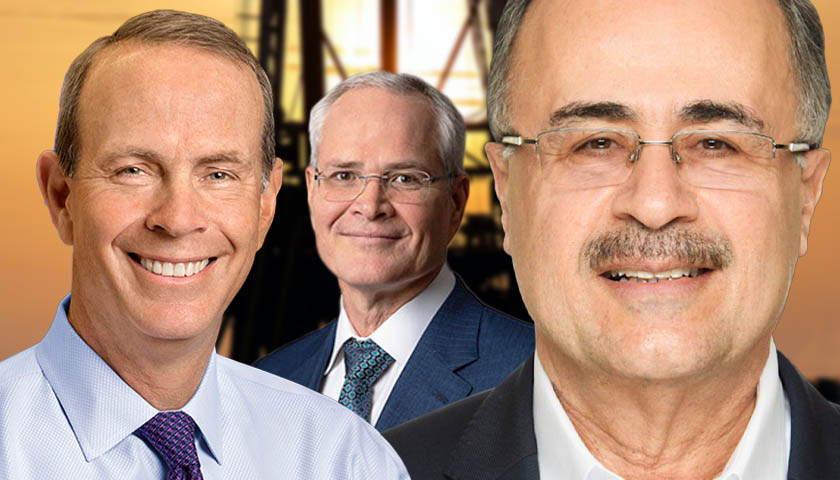

Read MoreBig Oil CEOs Thumb Nose at Green Energy Transition, Say Fossil Fuels Still Have ‘Essential Role’

Executives of major oil companies slammed the aggressive global push to renewable forms of energy and warned that such policies could crash economies.

Crude oil and natural gas continue to be key to the world economy’s health and cannot be discounted, CEOs of ExxonMobil, Chevron, Halliburton and Saudi Aramco said during the ongoing World Petroleum Congress in Texas on Monday. The executives agreed that climate change should be addressed, but not to the detriment of current energy needs.

“I understand that publicly admitting that oil and gas will play an essential and significant role during the transition and beyond will be hard for some,” Saudi Aramco CEO Amin Nasser said during his remarks at the summit, the Financial Times reported. People “assume that the right transition strategy is in place. It’s not,” Nasser said, Reuters reported. “Energy security, economic development and affordability are clearly not receiving enough attention.”

Read MoreDozens of Republicans Slam Biden Administration for Considering Crude Oil Export Ban

A large group of House Republicans penned a letter to top Biden administration officials Friday, urging them not to ban U.S. crude oil exports.

The GOP lawmakers, led by Texas Reps. Roger Williams and August Pfluger, said the move would be a “catastrophic mistake” and further exacerbate high energy prices in the letter addressed to Energy Secretary Jennifer Granholm and Commerce Secretary Gina Raimondo. The congressmen noted that a previous crude oil export ban had been opposed by Democrats and Republicans alike.

“President Biden’s war on American energy continues with his Administration’s latest discussions to reinstate the export ban on crude oil, which was repealed in 2015 on a bipartisan vote,” Williams said in a statement.

Read MoreCommentary: Biden Is Making Russia Great Again

Under former President Donald J. Trump, for the first time in decades, the United States became a net exporter of natural gas and oil. That helped to keep global energy prices relatively low. It also gave the United States leverage over the international system in ways it had not enjoyed since before the 1970s.

Alas, the propagation of the novel coronavirus from Wuhan, China, along with the ceaseless lies of the Western “mainstream” media made such a prosperous and secure future under Trump an impossibility.

In the eight months since assuming office under a cloud of controversy, Joe Biden has done more to harm America’s inherent strategic advantages in the global energy market than any U.S. rival could have imagined. Under Biden, the United States has gone from being a net exporter of global energy to begging the Organization of Petroleum Exporting Countries (OPEC) to produce more oil for the world to consume.

Read MoreTexas Democrats: Biden’s Energy Policies Will Cost Jobs, Create Dependence on Foreign Oil

Seven Democratic U.S. representatives have asked Speaker of the House Nancy Pelosi, D-Calif., and Senate Majority Leader Chuck Schumer, D-New York, to not target the oil and gas industry in the budget reconciliation bill before Congress.

Despite the concerns they and those in the industry have raised, Democrats in the U.S. House Natural Resources Committee pushed through a section of the bill, which includes billions of dollars in taxes, fines and fees on the oil and gas industry in the name of climate change.

Committee Chair Raúl M. Grijalva, D-Ariz., said the section of the bill that passed “invested in millions of American jobs” and put the U.S. “on a more stable long-term economic and environmental path.”

Read MoreBiden Gears Up for Renewed Fight Against Oil and Gas

A federal judge has ruled the Biden administration must resume allowing oil and gas leasing on federal land and waters, but the administration is saying it will not go down without a fight.

The Biden administration said it will appeal a court ruling allowing the leases, the latest development in a months-long battle between President Joe Biden and the oil and gas industry, even as gas prices continue to rise.

Read MoreLabor Shortage Slows Oil Production in Major Fracking State

A shortage of workers has contributed to a significant crude oil production slowdown in North Dakota, the second-largest U.S. oil hub behind only Texas.

The labor shortage has caused oil output to become “flat as a pancake,” North Dakota State Mineral Resources Director Lynn Helms told The Bismarck Tribune. Energy companies have struggled to find workers needed to do the laborious work — injecting water, sand and chemicals into wells to extract oil — associated with fracking.

“Most of these folks went to Texas where activity was still significantly higher than it was here, where they didn’t have winter and where there were jobs in their industry,” Helms said, according to the Tribune. “It’s going to take higher pay and housing incentives and that sort of thing to get them here.”

Read MoreOil Reaches Highest Price in Six Years Amid Low Supply, Output

Oil prices climbed to a six-year high Tuesday as the Organization of the Petroleum Exporting Countries (OPEC) and Russia continue to tamp down on global output, The Wall Street Journal reported.

An OPEC meeting was called off Monday, the WSJ reported. It was the group’s third attempt to discuss surging prices and an increase in oil consumption amid an opening global economy.

Read More