Former President Donald Trump’s social media company has sued The Washington Post for defamation over an article it published earlier this month and is seeking $3.78 billion in damages.

Read MoreCategory: Economy

Census Data Shows Several Florida Cities Ranked Highly for Population Growth

Data from the U.S. Census Bureau shows that while the exodus from large cities is slowing down, several Florida cities are still among the nation’s fastest-growing municipalities.

The Census Bureau’s latest report shows Florida had three out of the top 15 fastest-growing cities, both in terms of percentage and raw numbers.

Read MoreDisney Scraps New $1 Billion Florida Project amid DeSantis Feud

The Walt Disney Company has canceled plans to build a $1 billion installation in Florida amid an ongoing legal and political fight with Republican Gov. Ron DeSantis.

The project, known as the Lake Nona Town Center, included plans to build office space for the company near Orlando, Florida, and would have created upwards of 2,000 jobs with an average salary of $120,000 a year, according to the state’s Department of Economic Opportunity. Its cancellation was announced in an email to employees by Disney’s chairman of Parks and Resorts, Josh D’Amaro, on Thursday.

Read MoreAmericans’ Views of Housing Market Worse than After 2008 Market Crash

Americans’ views of the housing market have plunged as interest rates continue to rise because of government-fueled inflation.

Gallup released new polling data showing that only 21% of Americans say now is a good time to buy a house, down 9 percentage points from the previous year. This year and last year during the Biden administration are the only times that fewer than half of Americans said it was a good time to buy a house since Gallup began asking in 1978.

Read MoreVice Media Files for Bankruptcy to Ease Sale to Investors Including Soros Fund Manageement

Soros Fund Management (SFM) and other investors will buy Vice Media for about $225 million after the media company filed for bankruptcy protection Monday.

The digital media company was once valued at $5.7 billion, but is now relying on funds from bidders to continue operations until its sale is finalized in the next two to three months, according to a Monday press release. SFM was founded and is chaired by left-wing billionaire and philanthropist George Soros and is the principal asset manager for the Open Society Foundations, of which Soros is the founding chair.

Read More‘Anti-Capitalist’ Cafe Closes Down After a Year Due to a Lack of Capital

The Anarchist, a Canadian coffee shop dedicated to fighting capitalism, is going out of business on May 30, about one year after its opening due to a lack of capital, according to its owner. The café sold coffee and tea alongside books and merchandise promoting radical leftist ideas, and was ardently anti-capitalist. The business was unable to obtain enough capital to stay in business during a slow winter season, the cafe’s owner, Gabriel Sims-Fewer, wrote in an online announcement about the closure.

Read MoreU.S. Faces ‘Significant Risk’ of Breaking Debt Ceiling in First Weeks of June: CBO

The U.S. government faces a significant risk of not being able to pay its bills in the coming weeks without an increase to the debt limit, the Congressional Budget Office said Friday.

The warning comes as Democrats and Republicans remain far apart on negotiations over the debit limit. The debt ceiling is the maximum amount of debt the U.S. Department of the Treasury can issue.

Read MoreWhite House Aiming for Two-Year Deal on Debt Ceiling as Talks Stall: Report

White House staff are reportedly pushing a deal on the debt ceiling as talks between House Speaker Kevin McCarthy and President Joe Biden on a potential raise of the debt limit have been delayed.

The White House is seeking a debt-ceiling increase that would push back the borrowing limit by two years, according to Politico. In exchange, they are reportedly agreeing to caps on “discretionary” spending, which refers to all congressional appropriations excluding Medicare, Medicaid, and Social Security and some minor programs, according to Politico.

Read MoreNew Bank Fees to Cover Bailouts Could Be Passed on to Customers, Experts Say

The Federal Deposit Insurance Corporation (FDIC) announced a proposal on Thursday to charge new fees to replenish funds spent bailing out Silicon Valley Bank (SVB) and Signature Bank depositors in March that will cost Americans, according to experts who spoke to the Daily Caller News Foundation.

Under the proposal announced at the FDIC Board of Directors Meeting, the regulator would charge special assessment fees to an estimated 113 banks, mostly those with over $50 billion in assets and none under $5 billion in assets. The banks will pass the costs on to their customers, according to economists who spoke to the DCNF.

Read MoreData Shows Booming Florida Economy Despite Inflationary Headwinds

Data shows that despite lingering inflation, Florida’s economy is excelling.

The latest data from the Florida Office of Economic and Demographic Research shows tax revenues are up and federal data reveals the Sunshine State had the nation’s 10th lowest unemployment rate.

Read MoreReport: U.S. Economic Development Departments Pay Big Money for Few Gains

While billion-dollar economic development incentives are heavily expanding across the country, the agencies in charge of handing out those incentives claim to create or retain 625,000 jobs in their most recent fiscal years, according to a new report.

The Center for Economic Accountability tallied up the jobs claimed as part of incentive packages in the 50 states and Washington, D.C. and found job total would be less than 5% of the 15 million to 17 million jobs naturally created in the United States economy each year.

Read MoreCommentary: U.S. Government Will Not Default on Loans If Congress Doesn’t Raise the Debt Ceiling

Contrary to widespread claims that the U.S. government will default on its debt if Congress doesn’t raise the debt limit, federal law and the Constitution require the Treasury to pay the debt, and it has ample tax revenues to do this.

Nor would Social Security benefits be affected by a debt limit stalemate unless President Biden illegally diverts Social Security revenues to other programs.

Read MoreCommentary: Mr. President, the Debt Ceiling and Spending Cuts Were Linked in 2011 and 1996

“You just can’t. No one’s ever tied them together before.”

That was President Joe Biden on MSNBC on May 6, claiming that Congress has never increased the debt ceiling in exchange for budget, spending and regulatory changes.

There’s only one problem. It’s completely false.

Read MoreU.S. Crude Oil Production Approaches Pre-Pandemic Levels

For the first two months of 2023, production of crude oil in the U.S. neared pre-COVID levels, according to the U.S. Energy Information Administration.

The production of crude oil in the U.S. in January and February was the most since March 2020 when the pandemic hit.

The U.S. produced 12.54 million barrels of crude oil per day in January and 12.48 million barrels per day in February. That represented the highest levels since 12.80 million barrels per day in March 2020.

Read MoreCommentary: The Biden Admin Doesn’t Care About Creating Jobs – They Even Say So

Department of Interior Secretary Deb Haaland said the quiet part out loud last week. As the executive of our public lands agency, she does not believe that Americans need jobs because there are already so many jobs available. It’s better to lock up land, and lock down mining because who wants those jobs, when there are so many others?

Before the U.S. Senate Energy and Natural Resources Committee, Haaland told Sen. Josh Hawley, “Senator, I know that there’s like 1.9 jobs for every American in the country right now. So, I know there’s a lot of jobs,” which was her explanation for canceling cobalt mining permits for Twin Metals Minnesota, an underground mine proposed for the northeastern part of the state. America won’t need those jobs, she was saying.

Read MoreFlorida Lawmakers Finish Session by Approving $117 Billion Budget

The Florida legislative session has come to an end after state lawmakers made their final votes on the budget on Friday.

Senate Bill 2500, the General Appropriations Act, passed both chambers on day 60 of the regular session and is set to be far higher than initially planned, reaching an estimated $117 billion, $7 billion higher than the previous year’s budget.

Read MoreCommentary: The Great Carbon Capture Scam

Carbon capture is like burning witches.

In the 15th to 17th centuries, the elite in Europe and the United States believed that “evil humans were negatively affecting the climate and weather patterns.” The people were demanding something — anything — be done about famine and crop failure. There must be consequences, facts be damned, so inconvenient women on the fringes of society were labeled “witches” and burned at the stake in droves.

Read MoreAmericans’ Banking Fears Worst Since 2008 Financial Crisis

Americans are worried about the safety of their money in the banking system after multiple banks have collapsed in recent weeks, according to a new poll.

Gallup released the survey data, which showed that 19% are “very” worried about the safety of their money in banks and another 29% are “moderately” worried.

Read MoreBiden Administration’s Controversial Rule Raising Fees for Those with Good Credit Goes into Effect

The latest in a series of new Biden administration rule changes that charge higher fees to certain home buyers with good credit and lower fees for buyers with worse credit went into effect this week despite pushback from Republicans and many financial experts.

A group of U.S. House and Senate Republicans as well as state officials were unable to stop the rule, which a Biden administration official confirmed went into effect as planned Monday.

A coalition of Senate Republicans recently sent a letter to Sandra Thompson, director of the Federal Housing Finance Agency, the latest in several policy changes from the group. The agency implemented the rule change this week.

Read MoreCommentary: Recession Looms as Banks Collapse and the Economy Slows

The unemployment rate still remains at historic lows of 3.4 percent in April, according to the latest data by the Bureau of Labor Statistics, amid other worrying signs for the U.S. economy including a continued collapse of job openings, a string of bank failure and an overall slowing Gross Domestic Product (GDP).

In the survey, as the population increased by 171,000, those not in the labor force increased by 214,000 as labor participation dipped slightly by 43,000. Those who said they had a job increased by 139,000 after a 577,000 increase in March. As a result, the unemployment rate has actually ticked downward for two consecutive months from 3.6 percent in February, to 3.5 percent in March and now 3.4 percent in April.

Read MoreCommentary: Joe Biden Gambles on Default with No-Strings Increase of $31 Trillion Debt Ceiling

President Joe Biden is set to meet with House Speaker Kevin McCarthy (R-Calif.) and other Congressional leaders on May 9 to discuss the looming the $31.4 trillion debt ceiling. It’s about time.

So far, Biden’s only plan has been for Congress to simply increase it into perpetuity or else threaten to default, never bothering to address the dismal fiscal outlook facing the nation, even as regional banks continue to fail because of the unsustainable burden caused by taking on U.S. treasuries — a problem that will only grow as the White House Office of Management and Budget (OMB) projects the national debt will rise to $50.7 trillion by 2033.

Read MoreThe Biden Admin Just Made America’s Biggest Bank Even Bigger

Federal regulators sold recently failed regional lender First Republic Bank to JPMorgan Chase on Monday, enabling America’s largest bank to expand even more and spurring concerns about consolidation in the industry, economists told the Daily Caller News Foundation.

JPMorgan Chase agreed to take on all of First Republic’s $92 billion in deposits and is additionally purchasing the vast majority of the failed bank’s assets, including roughly $173 billion in loans and $30 billion in securities, according to a JPMorgan Chase press release. The giant had $3.7 trillion in assets and $2.4 trillion in deposits as of March 31.

Read MoreBlue States Suffer Largest Population and Tax Revenue Losses as Red States See Largest Gains, IRS Data Shows

Even as Democratic governors such as California’s Gavin Newsom and Illinois’ J.B. Pritzker slam red state policies, their residents are fleeing in droves for Republican-controlled states.

IRS migration data released late last week shows that California lost more residents than any other state, with a net loss of nearly 332,000 people and more than $29 billion in adjusted gross income in 2021. The state with the second largest population loss is New York, which saw a net loss of over 262,000 residents and $24.5 billion in income. Illinois, meanwhile, suffered a net loss of 105,000 people in 2021 and $10.8 billion in income.

Read MoreCommentary: Another California Bank Fails After $100 Billion Run on Deposits and Rising Interest Rates Forces First Republic into FDIC Receivership

The Federal Deposit Insurance Corporation (FDIC) and the California Department of Financial Protection and Innovation put the $229.1 billion California-based First Republic Bank into receivership today on May 1, while the FDIC also entered into a “purchase and assumption agreement” with JP Morgan-Chase Bank for the nation’s largest bank to assume First Republic’s assets as well as its $103.9 billion of deposits.

Another one bites the dust.

Read MoreFederal Regulators Seize, Sell Major Bank to JPMorgan Chase

Federal regulators took ownership of the First Republic Bank and sold it to JPMorgan Chase on Monday, marking the second-largest bank failure in U.S. history.

Read MoreModerna Under Fire as CEO Earned Nearly $400 Million in Stock Options and a 50 Percent Raise Last Year

Moderna is under fire after financial records showed the biotech company’s CEO Stephane Bancel earned around $393 million in 2022 from stock options he exercised as he received a 50% raise.

Bancel, whose firm is known for producing the COVID-19 vaccine, received $1.5 million in 2022, an increase of 50% from 2021, and Moderna increased his target cash bonus, a March securities and exchange commission filing shows.

Read MoreTrip to U.K. Solidifies Possible Financial Help with Property Insurance Reform

As part of the last leg of a four-country trade mission, Florida Gov. Ron DeSantis met with political and business leaders in the U.K. to address ongoing and new trade relationships. He also secured a commitment from British companies to increase access to property insurance carriers to stabilize Florida’s market.

While in London, DeSantis met with Foreign Minister James Cleverly and MP Kemi Badenochs, the Secretary of State for Business and Trade and president of the Board of Trade in the UK.

Read MoreFlush with Cash, Big Oil Is Poised for a Huge Shopping Spree

While U.S. oil and gas deals slowed considerably in the first quarter of 2023, industry players are poised to make significant investments in shale over the next year, according to Axios.

Oil and gas mergers and acquisitions fell to $14.8 billion in the first quarter, down 47% from the fourth quarter of 2022, according to a report from accounting firm KPMG. However, after a record-breaking year left companies flush with cash, producers will be incentivized to “secure inventory, create operational efficiencies and put their capital to work,” Mike Harling, energy sector lead partner at KPMG, told Axios.

Read MoreOutrage Continues over Federal Rule to Charge Higher Fees to Home Buyers with Better Credit

A new federal rule that would charge higher fees to home buyers with good credit to help subsidize those with poor credit goes into effect Monday.

The Federal Housing Finance Agency announced in January it would increase Loan-Level Price Adjustment fees for mortgage borrowers with higher credit scores to help keep fees lower for those with worse credit.

Read MoreRegulators Knew Silicon Valley Bank Was in Trouble Since 2021, Did Not Step In

A closer look at the months leading up to the collapse of Silicon Valley Bank, the second-largest bank collapse in history, shows that regulators saw the warning signs since last year but did not step in.

SVB’s collapse sent shockwaves through the markets, destabilized the economy, and raised fears of a domino effect of other banks. Seemingly backing those fears, other banks have recently collapsed as well.

Read MoreGDP Report: U.S. Economic Growth Slows

The U.S. economy is growing at a slower pace, newly released economic data shows.

The Bureau of Economic Analysis released Gross Domestic Product Data Thursday that showed the size of the U.S. economy increased by 1.1% in the first quarter of 2023, more slowly than the previous quarter.

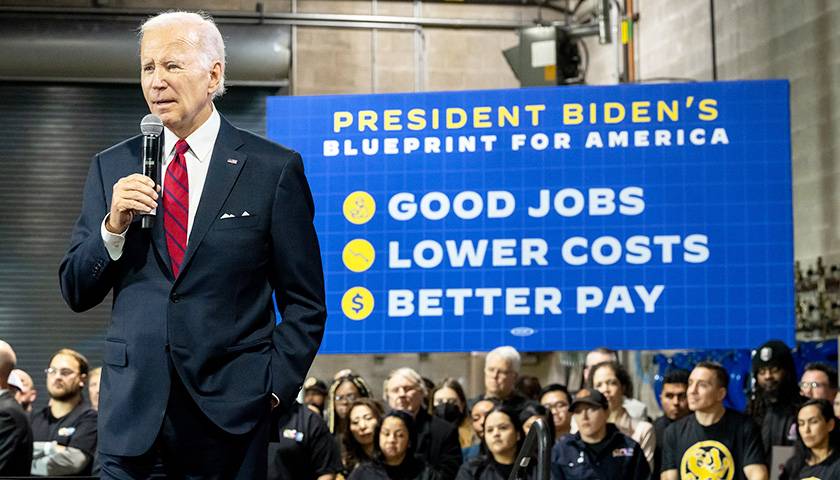

Read MoreCommentary: On Economy, Biden Re-Election Faces Challenges

As President Biden embarks on his reelection campaign, a majority of American voters are dissatisfied with his stewardship of the U.S. economy. Aware of the general angst among the electorate, Biden is threading the needle by saying he’s running on the strength of his overall record, while vowing to “finish the job” that he started when he stepped into the Oval Office. It’s a daunting task, with an overwhelming majority of registered voters expressing deep pessimism about the economy: 40.2% say the United States is currently in a recession, 17% call it a general state of stagnation, and 10.4% believe the country is in an outright depression.

Read MoreReport: Disney Set to Lay Off Thousands This Week in Latest Round of Job Cuts

Disney is reportedly expected to lay off thousands of people this week in its largest round of planned layoffs yet as the company looks to cut corporate costs.

The company will cut 4,000 jobs through Thursday, as it looks to lay off 7,000 workers overall, according to multiple media reports.

Read MoreCommentary: The ‘Limit, Save, Grow’ Plan’s Discretionary Spending Caps that Save More than $3 Trillion Might Not Be Enough

House Speaker Kevin McCarthy (R-Calif.) and the House Republican majority have unveiled their spending plan for the next decade, the Limit, Save, Grow Act, that will be tied to a $1.5 trillion increase in the $31.4 trillion national debt ceiling, the centerpiece of which imposes discretionary budget caps beginning in 2024, but which will be set at 2022 levels, which could save more than $3.2 trillion over the next decade, according to an estimate by the Committee for a Responsible Federal Budget.

While an official score still has not come in from the Congressional Budget Office, the proposal stands out as a promise kept on McCarthy’s part to use the must-pass debt ceiling to restore some semblance of fiscal sanity to the out-of-control federal budget and national debt, the latter of which the White House Office of Management and Budget projects will rise to a gargantuan $50.7 trillion by 2033.

Read MoreTucker Carlson Leaves Fox News: ‘Last Program Was Friday’

Fox News host Tucker Carlson is leaving the network, Fox announced Monday.

Read MoreDemocrats Join ‘Patriotic Millionaires’ Group to Call for 90 Percent Tax on Income Above $100 Million

A group of Democratic lawmakers and the Patriotic Millionaires, an organization of high-income and high net worth individuals favoring higher taxes on the wealthy, are calling on Congress to pass a 90% income tax on incomes above $100 million as fears of a recession are growing.

Abigail Disney, a documentary filmmaker who is the granddaughter of Roy Disney, cofounder of The Walt Disney Company, joined the lawmakers to call for higher taxes on “extremely high income.”

Read MoreCommentary: Tax Armageddon Day Is Coming

Benjamin Franklin famously wrote in 1789 that “our new Constitution is now established and has an appearance that promises permanency; but in this world nothing can be said to be certain, except death and taxes.” Death and taxes are fated. However, are enormous tax hikes also a fait accompli? Is it a certainty – ‘an accomplished fact’ – that the White House and Congress will repeal tax reforms that worked? Tax breaks that helped small business owners and families.

For the past several days Americans have been scrambling to make the deadline to complete their 2022 tax returns. Most taxpayers will be relieved once the ordeal is done. However, here’s an unfortunate reality: if Washington fails to act, the federal tax code is headed for major changes in just a couple of years, including massive tax hikes on families and small businesses.

Read MoreEurope Imposes First-Ever ‘Climate Tax’ on Imported Goods

The European Parliament finalized legislation Tuesday that will impose taxes on imports based on the greenhouse gas emissions made during their production, despite the objections raised by companies in the U.S. and China.

The European Union’s (E.U.) Carbon Border Adjustment Mechanism (CBAM) would first take effect in 2026, and first cover emissions from companies producing iron, steel, cement, aluminum, fertilisers, electricity and hydrogen, according to the European Parliament. The taxes have been criticized by firms in the U.S., who are concerned about unnecessary regulation and red tape, and firms in China and the developing world, who use less green sources of energy than competitors in the U.S. and E.U., according to the Wall Street Journal.

Read MoreCommentary: After Decades of Outsourcing to China, the U.S. is Running Out of Children’s Antibiotics

Acute shortages of orally delivered amoxicillin, penicillin and other children’s antibiotics throughout the 2022 and 2023 cold and flu season have made it difficult for doctors to treat normal childhood illnesses like ear infections, bronchitis, strep throat and rarer cases of infections caused after suffering Respiratory Syncytial Virus (RSV), and also sickle cell disease—for months.

The Food and Drug Administration (FDA) issued a warning about the amoxicillin shortage in Oct. 2022 just at the start of the cold and flu season. But since then, no statement has been issued by President Joe Biden about what appears to be an underreported public health crisis.

Read MoreReport: CVS ‘Gender Transition Guidelines’ Urge All Employees to Become Allies of Transgender Workers

CVS Health’s “gender transition guidelines” for employees shows the drugstore chain catering to transgender employees by allowing them to use whichever sex’s restroom they prefer, insisting all others use their preferred pronouns, and providing medical leave for their gender transition, a Fox Business report says.

Read MoreSouthwest Airlines Grounds Flights Due to ‘Technology Issues’

Southwest Airlines shut down on Tuesday due to what it says is “intermittent technology issues,” just months after the airline suffered from a major meltdown over the holiday season.

Read MoreFlorida’s DeSantis Seeks New Legislation to Curb Disney Autonomy

Gov. Ron DeSantis wants the Florida Legislature to enact new legislation to ensure that Walt Disney World loses its self-governing status.

DeSantis held a news conference in Lake Buena Vista on Monday to give an update on the Reedy Creek Improvement District, which is home to Disney World.

Read MoreBiden’s ‘Green Manufacturing’ Plan Is Running into Serious Real Estate Problem: Report

President Joe Biden’s push to boost “green” U.S. manufacturing is facing headwinds from a lack of available real estate, Reuters reported Thursday, citing development experts and local government officials.

Roughly half of all megasite projects — typically defined as large factories spanning more than 1,000 acres — announced since 2004 were announced in the past five years, Reuters reported. While the U.S. has a significant amount of available land, most of it is not ready for the large multibillion dollar projects companies are looking to develop before tax credits under Biden’s signature climate law, the Inflation Reduction Act, begin to phase out at the end of the decade.

Read More50-State Report: GOP-Led States Are in Best Economic Condition

A new report ranks all 50 states from best to worst for economic conditions, showing which states have improved, and worsened, in creating an economic climate where businesses want to invest.

The American Legislative Exchange Council released the state analysis, which ranks Utah as the number one state, North Carolina as second, and Arizona as third. Idaho and Oklahoma fill out the top five spots, ranking fourth and fifth, respectively.

Read MoreFederal Reserve Predicts ‘Mild Recession’ This Year

Federal Reserve economists project that the recent bank collapses will create a “mild recession” later this year, posing potential problems for President Joe Biden and the Democratic Party ahead of the 2024 presidential election.

The Fed’s projection “included a mild recession starting later this year, with a recovery over the subsequent two years,” according to minutes released Wednesday from the central bank’s March 21-22 meeting.

Read MoreReport: Florida Ranked First in Economic Performance over Past Decade

Florida is yet again one of the top 10 ranked states for economic performance and economic outlook.

The annual Rich States, Poor States report from the American Legislative Exchange Council shows the Sunshine State outperforming all other states economically over the past decade and for net in-migration, thanks to the state’s low tax burdens and worker-friendly policies.

Read MoreGordon Chang Commentary: It’s Time to Bankrupt China

“We are probably not going to be able to do anything to stop, slow down, disrupt, interdict, or destroy the Chinese nuclear development program that they have projected out over the next 10 to 20 years,” said Chairman of the Joint Chiefs of Staff General Mark Milley on March 29 at a hearing of the House Armed Services Committee. “They’re going to do that in accordance with their own plan.”

Milley is wrong about China’s nuclear weapons ambitions. He is, unfortunately, expressing the same pessimism that pervaded the Nixon, Ford and Carter years, when the American foreign policy establishment took the Soviet Union as a given and therefore promoted détente.

Read MoreInflation Rises Again in March, but at Slower Pace

Inflation rose again in March, but at a slower pace than previous months, the U.S. Bureau of Labor Statistics latest consumer pricing data shows.

The Consumer Price Index rose 0.1% in March, contributing to a 5% rise over the last 12 months, about double what economists say is a healthy inflation rate. Price changes varied by the respective good and service.

Read MoreEPA Proposes New Standards to Require Two-Thirds of New Car Sales by 2032 Be EVs

The Environmental Protection Agency on Wednesday announced what is being considered its strongest-ever proposed pollution standards for gas-powered vehicles – which if enacted would effectively mandate that 67 percent of new passenger vehicles sold in the U.S. in 2032 must be zero-emission ones.

The rule has been expected for weeks and is a dramatic, proposed increase from President Biden’s stated goal of 50 percent zero-emission passenger car sales – including battery-powered electric vehicles, plug-in hybrids and fuel-cell vehicles – by 2030. It would also likely and dramatically increase EV sales, which accounted for just 5.6 percent of new car sales in the U.S. last year, according to Road & Track.com.

Read More‘A Devious and Dangerous Game:’ Vivek Ramaswamy Spars with NYC Comptroller over Green Investing

Republican presidential candidate Vivek Ramaswamy sparred with New York City Comptroller Brad Lander on Tuesday over considering green investments for pension plans.

“I am frankly worried about the pension plan participants in the funds because fossil fuel companies dramatically outperform the S&P by almost 80 percent and they outperformed the very ESG funds that divested from fossil fuel companies by nearly 100 percent,” Ramaswamy said during an appearance on CNBC’s “Last Call.”

Read More