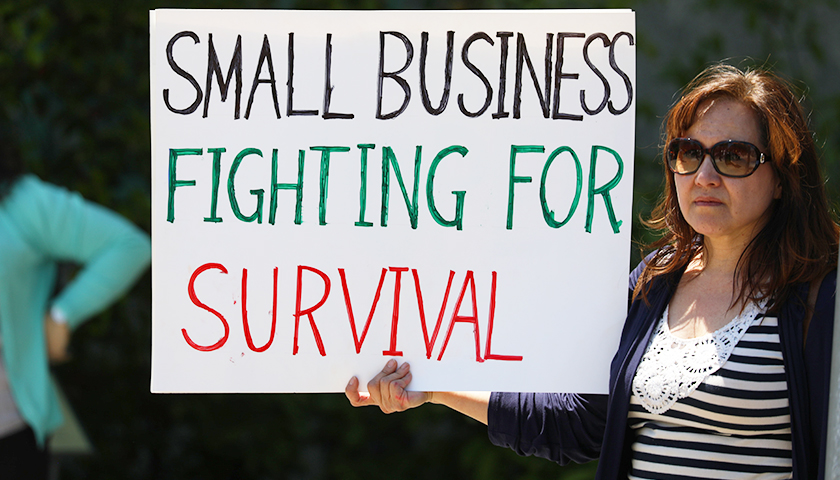

As President Joe Biden promotes his several trillion dollars in proposed federal spending, Republicans and small businesses are raising the alarm, arguing the taxes needed to pay for those spending plans are a threat to the economy.

The House Ways and Means Committee met Thursday to discuss infrastructure development and in particular the impact of proposed tax increases to pay for it. Rep. Kevin Brady, R-Texas, the ranking member on the committee, argued that only 7% of Biden’s proposed infrastructure bill goes to infrastructure and that raising taxes would incentivize employers to take jobs overseas.

“As bad as the wasteful spending is, worse yet, it’s poisoned with crippling tax increases that sabotage America’s jobs recovery, hurts working families and Main Street businesses, and drives U.S. jobs overseas,” Brady said. “We cannot fund infrastructure on the backs of American workers.”

Read More